LINKVEST CAPITAL EXPANDS BOARD OF DIRECTORS WITH THREE DISTINGUISHED INDUSTRY LEADERS

MIAMI, Fla. (May 28, 2025)–Linkvest Capital, a leading Miami-based co-investment platform specializing in alternative real estate investments, is pleased to announce the appointment of three highly respected professionals to its Board of Directors: Donald Scarcello, Juan Constantino Martínez, and Dr. Eli Beracha. These accomplished leaders bring extensive expertise in real estate investment, finance, and strategic management, further strengthening Linkvest Capital’s mission to provide exceptional, low-risk investment opportunities to its co-investors. “We are honored to welcome Donald, Juan, and Dr. Beracha to our Board of Directors,” stated Camilo Niño, founder and CEO, Linkvest Capital. “Their collective expertise and leadership in investment management, financial services, and real estate strategy will be invaluable as we continue to grow and enhance our offerings for investors seeking capital preservation, cash flow, and long-term value creation.” Donald Scarcello is a seasoned expert in investment real estate and banking, with over 25 years of experience. As the Managing Principal of SMV Capital Group, he leads the firm’s strategy, performance, and daily operations. Previously, Donald served as Executive Vice President at a Fortune Global 100 financial services firm, managing a multi-billion-dollar P&L and overseeing assets totaling more than $160 billion. He has executed over $30 billion in real estate trades and currently owns and manages value-add commercial real estate projects along the East Coast. Donald holds a bachelor’s degree in legal studies and business administration from the University of Central Florida and has completed executive education programs at the University of North Carolina Kenan-Flagler Business School and IMD Business School in Lausanne, Switzerland. Juan Constantino Martínez is a distinguished family office executive with extensive experience in business administration and board governance. He holds an MBA from the Kellogg School of Management at Northwestern University and an MBA with an emphasis on Family Business from the Coles College of Business at Kennesaw State University. Over the years, Juan has served as a board member for leading organizations, including Grupo Nutresa S.A., Grupo Sura, and Sociedad Portafolio S.A. He is currently a board member of Prebel, a third-generation family business, and serves as Director of Martínez Bravo Family Office, a role he has held since 1999. His deep understanding of investment strategies and corporate governance will provide valuable insights for Linkvest Capital’s continued expansion. Dr. Eli Beracha is a renowned expert in real estate and finance, currently serving as Professor, Department Chair, and Director of the Tibor & Sheila Hollo School of Real Estate at Florida International University. He holds a Ph.D. in Finance with a concentration in Real Estate Investment from the University of Kansas and has published extensively in top academic journals. His research has been featured in major publications such as The Wall Street Journal, The Economist, CNBC, and Forbes. As a co-founder of influential real estate indices and a trusted advisor to leading real estate funds, Dr. Beracha brings a wealth of knowledge in quantitative modeling, portfolio valuation, and investment strategy to Linkvest Capital’s Board. With over 15 years of experience in structuring and managing alternative real estate investments, Linkvest Capital has deployed approximately $1.4 billion across short-term commercial real estate loans, equity in multifamily and mixed-use developments, and commercial, industrial, and triple-net asset acquisitions in Florida and the Southeastern U.S. The addition of these three esteemed board members underscores Linkvest Capital’s commitment to excellence, innovation, and strategic growth. For more information on Linkvest Capital, please call (305) 523-6576, email [email protected], or visit www.linkvestcapital.com. About Linkvest Capital Linkvest Capital is a co-investment platform offering direct access to unique, low-risk investment opportunities across three distinct alternatives: (1) short-term commercial real estate loans, (2) equity in mixed-use developments, and (3) acquisitions and management of commercial, industrial and triple net assets in Florida and the Southeastern US. Linkvest was created by investors, to source and structure the best deals for investors. Over 15 years, Linkvest has invested and managed approximately $1.4 billion in alternative real estate investments with compelling risk-adjusted returns, attracting exceptional co-investors seeking capital preservation, cash flow and value investing strategies.

This Week’s South Florida Deal Sheet:

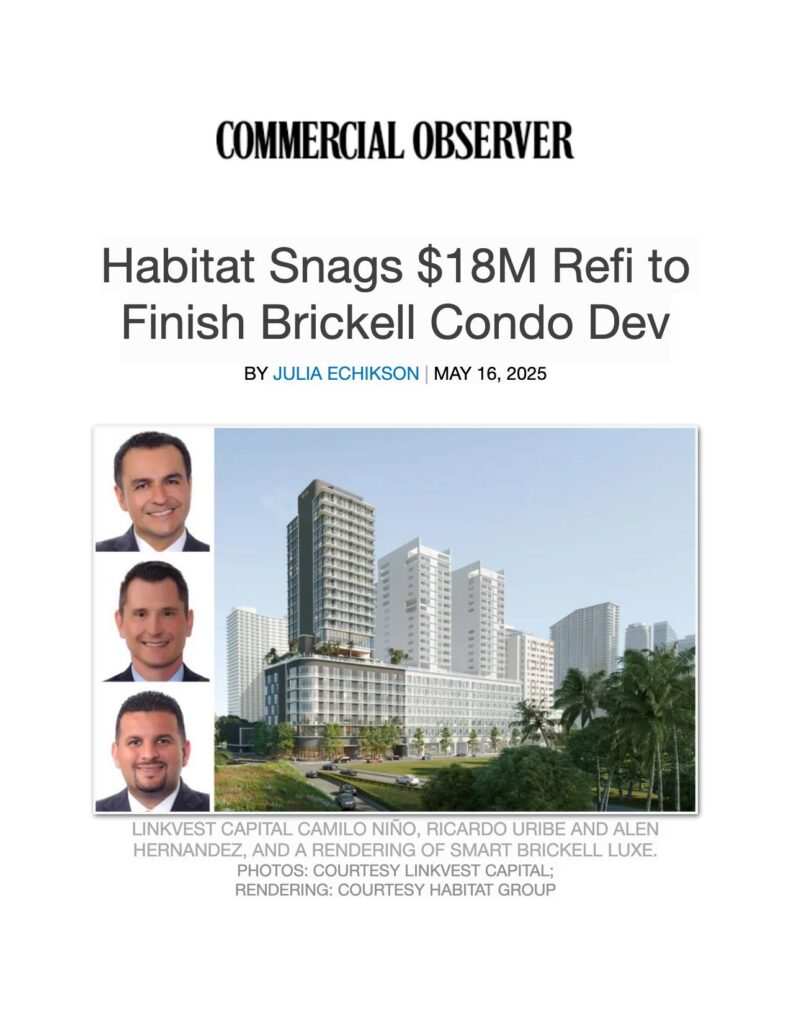

LINKVEST CAPITAL CLOSES $17.6 MILLION LOAN FOR FINAL PHASE OF SMART BRICKELL DEVELOPMENT IN MIAMI

Financing Package Supports Land Refinancing and Ongoing Construction of Smart Brickell Luxe, a Condo-Hotel by Habitat Group in Miami MIAMI, Fla. (May 14, 2025)–Linkvest Capital, through its private lending affiliate LV Lending, today announced the closing of a $17,662,500 million loan to refinance the land and fund the ongoing construction for Smart Brickell Luxe, the third and final phase of the three-tower Smart Brickell condo. The luxury condo-hotel is developed by Habitat Group, a seasoned Miami-based real estate firm led by Santiago Vanegas and Andrés Roa. The loan also includes refinancing of construction debt associated with Smart Brickell II. Financing was provided by Camilo Niño, Ricardo Uribe, and Alen Hernandez of Linkvest Capital and closed May 12th. Located at 259-267 SW 9th Street in the heart of Brickell, the Smart Brickell Luxe condo-hotel will total 192,422 square feet and feature a 23-story tower with 53 luxury condominium residences and 78 condo-hotel units. To date, 126 of the 131 units, approximately 96 percent of the project, have been pre-sold. Completion is slated for March 2028. The first two phases of Smart Brickell have been completed and successfully sold out. Habitat Group broke ground on Smart Brickell Luxe in December 2024. Linkvest Capital’s financing includes an initial disbursement of $8.6 million to refinance the Smart Brickell Luxe land loan and construction loan for Smart Brickell II. The remaining $9 million will be allocated to fund the ongoing construction of Smart Brickell Luxe. This marks the latest collaboration between Linkvest Capital and Habitat Group, who have partnered on more than six successful transactions since 2019. Some of the previous deals include the construction financing for Smart Brickell II, acquisition financing for El Vedado Condominium, and land acquisition for Millux Place. “Over the years, we’ve built a strong relationship with Habitat Group and are proud to support their continued growth,” stated Camilo Niño, principal, Linkvest Capital. “Smart Brickell Luxe exemplifies the high-quality developments they’re known for—demonstrated by robust pre-sales and expert execution. We are thrilled to serve as their financial partner and look forward to seeing this final tower take shape.” Smart Brickell Luxe is located just blocks from Brickell City Centre and Mary Brickell Village, surrounded by shops, restaurants and entertainment. The project is also conveniently located 10 minutes from Kaseya Center, 15 minutes from the Design District, 20 minutes from South Beach, and 25 minutes from Miami International Airport. For more information on Linkvest Capital, please call (305) 523-6576, email [email protected], or visit www.linkvestcapital.com. About Linkvest Capital Linkvest Capital is a co-investment platform offering direct access to unique, low-risk investment opportunities across three distinct alternatives: (1) short-term commercial real estate loans, (2) equity in mixed-use developments, and (3) acquisitions and management of commercial, industrial and triple net assets in Florida and the Southeastern US. Linkvest was created by investors, to source and structure the best deals for investors. Over 15 years, Linkvest has invested and managed approximately $1.4 billion in alternative real estate investments with compelling risk-adjusted returns, attracting exceptional co-investors seeking capital preservation, cash flow and value investing strategies.

Habitat Snags $18M Refi to Finish Brickell Condo Dev

Brickell condo/hotel project secures $18 million

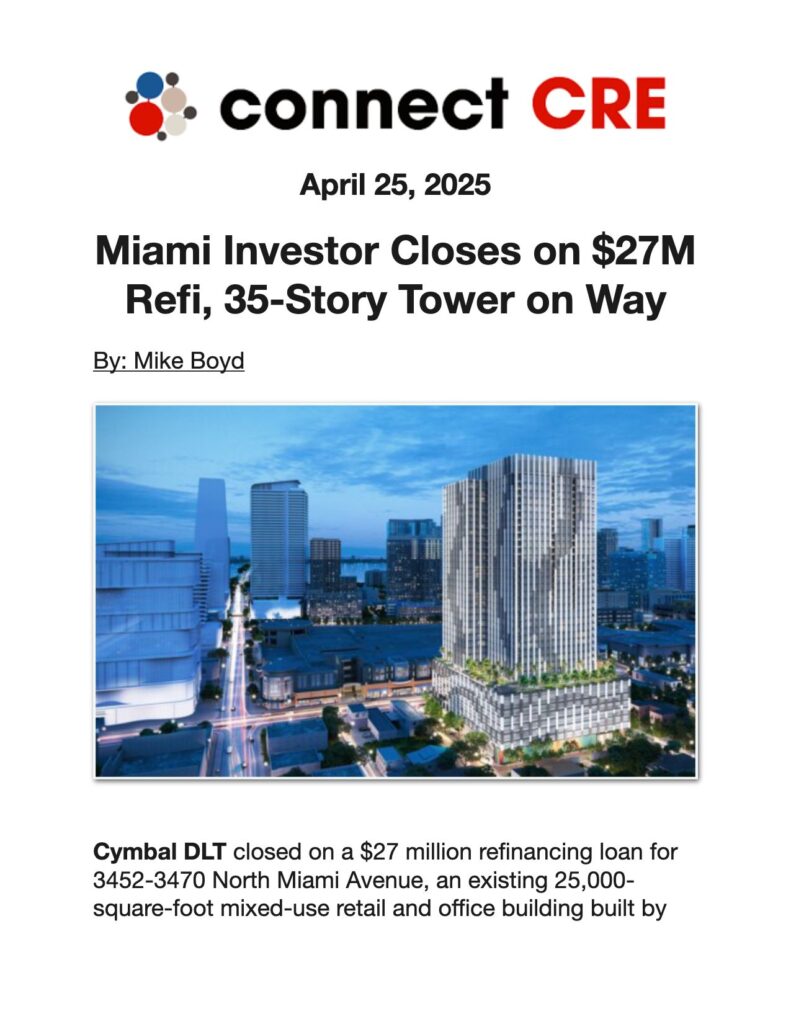

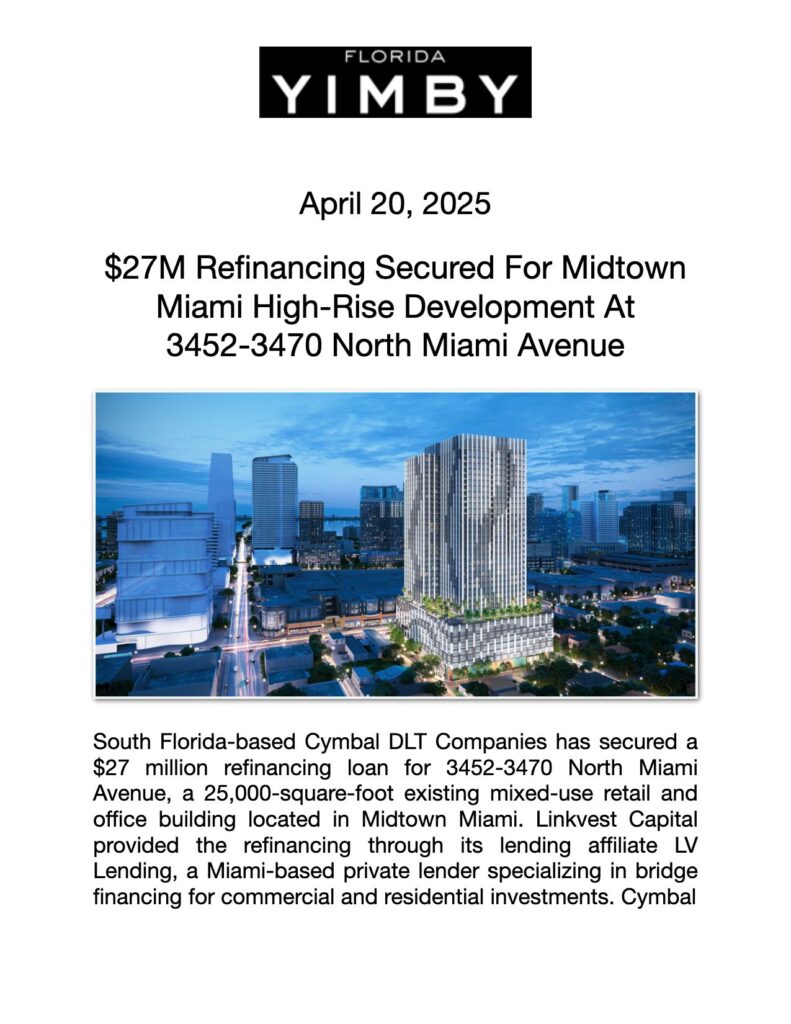

Miami Investor Closes on $27M Refi, 35-Story Tower on Way

$27M Refinancing Secured For Midtown Miami High-Rise Development At 3452-3470 North Miami Avenue

LINKVEST CAPITAL CLOSES THREE NEW DEALS AMID MARKET VOLATILITY

MIAMI (April 14, 2025) – Despite ongoing economic uncertainty, smaller-scale transactions are fueling steady momentum in South Florida’s real estate market. I’m writing to share news of three recently closed deals involving Linkvest Capital and its affiliates, underscoring a clear trend: continued market activity in the sub-$10 million range where flexibility and speed are driving deal flow. Daniel “Danny” Diaz Leyva, partner and chair of the Florida real estate practice at Day Pitney, represented Linkvest Capital in all three transactions. “We’re still seeing consistent market activity despite broader headwinds,” said Diaz Leyva. “In today’s environment, more transactions are landing in the sub-$10 million range, where there’s room for speed, flexibility, and creativity on both sides of the table and largely funded by ultra-high net worth individuals and families.” To date, Linkvest Capital has participated in over 800 real estate transactions across Florida, including more than 650 bridge loans. For more information, please contact Linkvest (LV) Lending at (305) 523-6576, email [email protected], or visit linkvestcapital.com.

LINKVEST CAPITAL CLOSES $27M REFINANCING FOR MIDTOWN MIAMI HIGH RISE DEVELOPMENT

MIAMI (April 14, 2025) – South Florida-based Cymbal DLT Companies (Cymbal DLT) has successfully closed on a $27 million refinancing loan for 3452-3470 North Miami Avenue, an existing 25,000-square-foot mixed use retail and office building built by Cymbal DLT and located at 3452-3470 North Miami Avenue in Midtown Miami. The loan was issued by Linkvest Capital, through its lending affiliateLV Lending, a local private lender focused on bridge loans for commercial and residential investment. Cymbal DLT has paid off New Wave’s $19 million loan provided in 2022. The refinancing will pave the way for the redevelopment of the property into an architecturally significant tower consisting of 598 multifamily units and 20,000 square feet of retail, slated to break ground in 2026. “Recognizing the area’s potential over two decades ago, we are long-term investors in Midtown Miami, contributing to its vibrant growth with high-quality projects, and are excited about the opportunity to continue elevating both the neighborhood and the site,” said Cymbal DLT’s co-founders, Asi Cymbal and Hector Delatorres. “Our in-house construction vertical allows us to build more efficiently and cost-effectively, accelerating project timelines. This streamlined approach also enables us to continue elevating both the neighborhood and the site, further enhancing Midtown’s vibrant appeal.” Recognizing the potential of this site and neighborhood, Cymbal DLT acquired the 1.36-acre property in 2003, transforming it from an industrial site into a Class A retail and office development. Showcasing Cymbal’s long-term vision for the area, the firm has plans to redevelop the property into an Arquitectonica-designed 35-story multifamily development under Florida’s Live Local Act featuring approximately 598 units with a portion designated for residents earning at or below 120% of the area’s median income. “We are proud to have served as a financial partner to Cymbal DLT on the refinancing of this transformative development,” stated Alen Hernandez, commercial director, Linkvest Capital. “This project is a testament to their vision and commitment to quality. At Linkvest, we focus on building long-term relationships and providing flexible, strategic capital solutions. Our ability to move quickly and structure deals creatively sets us apart in today’s competitive market, and we look forward to supporting more of Cymbal DLT’s projects in the future.” Situated at the nexus of Miami’s Midtown and Design District neighborhoods, the development is designed to maximize the pedestrian experience with a vibrant promenade along North Miami Avenue and a dedicated cross-block pedestrian passage. Residents will enjoy easy access to a variety of shopping, dining, and cultural venues within walking distance, as well as direct proximity to I-95 and the Julia Tuttle Causeway to Miami Beach. Linkvest, through its lending affiliate, has originated more than 650 bridge loans, offering flexible funding solutions to real estate investors and developers across Florida. For more information, please contact Linkvest (LV) Lending at (305) 523-6576, email [email protected], or visit linkvestcapital.com.

LINKVEST CAPITAL SELLS MEDICAL CENTER IN HIALEAH FOR $6.5 MILLION

MIAMI (April 4, 2025) – Linkvest Capital, an alternative co-investment network, in partnership with Cornerpoint Partners, has announced the sale of the Las Mercedes (Pasteur) Medical Center, located at 4440 W. 16th Ave., Hialeah, Florida. The 10,662-square-foot property was acquired by De Paz Holdings LLC for $6.5 million. The transaction closed on April 4, 2025. The two-story building was originally purchased by Linkvest Capital and Cornerpoint Partners in August 2019 for $4.7 million. Las Mercedes Medical Services is one of South Florida’s leading healthcare providers, operating over 17 strategically located centers throughout Miami-Dade and Broward counties. The Hialeah facility, built in 1985, is part of Flamingo Park Plaza, a 192,460-square-foot retail center anchored by Dollar Tree, Goodwill, and Navarro Discount Pharmacy. To date, Linkvest Capital has participated in over 800 real estate transactions across Florida, including more than 650 bridge loans. For more information, please contact Linkvest (LV) Lending at (305) 523-6576, email [email protected], or visit linkvestcapital.com.