LINKVEST CAPITAL CLOSES $27M REFINANCING FOR MIDTOWN MIAMI HIGH RISE DEVELOPMENT

MIAMI (April 14, 2025) – South Florida-based Cymbal DLT Companies (Cymbal DLT) has successfully closed on a $27 million refinancing loan for 3452-3470 North Miami Avenue, an existing 25,000-square-foot mixed use retail and office building built by Cymbal DLT and located at 3452-3470 North Miami Avenue in Midtown Miami. The loan was issued by Linkvest Capital, through its lending affiliateLV Lending, a local private lender focused on bridge loans for commercial and residential investment. Cymbal DLT has paid off New Wave’s $19 million loan provided in 2022. The refinancing will pave the way for the redevelopment of the property into an architecturally significant tower consisting of 598 multifamily units and 20,000 square feet of retail, slated to break ground in 2026. “Recognizing the area’s potential over two decades ago, we are long-term investors in Midtown Miami, contributing to its vibrant growth with high-quality projects, and are excited about the opportunity to continue elevating both the neighborhood and the site,” said Cymbal DLT’s co-founders, Asi Cymbal and Hector Delatorres. “Our in-house construction vertical allows us to build more efficiently and cost-effectively, accelerating project timelines. This streamlined approach also enables us to continue elevating both the neighborhood and the site, further enhancing Midtown’s vibrant appeal.” Recognizing the potential of this site and neighborhood, Cymbal DLT acquired the 1.36-acre property in 2003, transforming it from an industrial site into a Class A retail and office development. Showcasing Cymbal’s long-term vision for the area, the firm has plans to redevelop the property into an Arquitectonica-designed 35-story multifamily development under Florida’s Live Local Act featuring approximately 598 units with a portion designated for residents earning at or below 120% of the area’s median income. “We are proud to have served as a financial partner to Cymbal DLT on the refinancing of this transformative development,” stated Alen Hernandez, commercial director, Linkvest Capital. “This project is a testament to their vision and commitment to quality. At Linkvest, we focus on building long-term relationships and providing flexible, strategic capital solutions. Our ability to move quickly and structure deals creatively sets us apart in today’s competitive market, and we look forward to supporting more of Cymbal DLT’s projects in the future.” Situated at the nexus of Miami’s Midtown and Design District neighborhoods, the development is designed to maximize the pedestrian experience with a vibrant promenade along North Miami Avenue and a dedicated cross-block pedestrian passage. Residents will enjoy easy access to a variety of shopping, dining, and cultural venues within walking distance, as well as direct proximity to I-95 and the Julia Tuttle Causeway to Miami Beach. Linkvest, through its lending affiliate, has originated more than 650 bridge loans, offering flexible funding solutions to real estate investors and developers across Florida. For more information, please contact Linkvest (LV) Lending at (305) 523-6576, email [email protected], or visit linkvestcapital.com.

LINKVEST CAPITAL SELLS MEDICAL CENTER IN HIALEAH FOR $6.5 MILLION

MIAMI (April 4, 2025) – Linkvest Capital, an alternative co-investment network, in partnership with Cornerpoint Partners, has announced the sale of the Las Mercedes (Pasteur) Medical Center, located at 4440 W. 16th Ave., Hialeah, Florida. The 10,662-square-foot property was acquired by De Paz Holdings LLC for $6.5 million. The transaction closed on April 4, 2025. The two-story building was originally purchased by Linkvest Capital and Cornerpoint Partners in August 2019 for $4.7 million. Las Mercedes Medical Services is one of South Florida’s leading healthcare providers, operating over 17 strategically located centers throughout Miami-Dade and Broward counties. The Hialeah facility, built in 1985, is part of Flamingo Park Plaza, a 192,460-square-foot retail center anchored by Dollar Tree, Goodwill, and Navarro Discount Pharmacy. To date, Linkvest Capital has participated in over 800 real estate transactions across Florida, including more than 650 bridge loans. For more information, please contact Linkvest (LV) Lending at (305) 523-6576, email [email protected], or visit linkvestcapital.com.

LINKVEST CAPITAL FACILITATES $1.4 MILLION LOAN FOR OFFICE SPACE REFINANCING IN BRICKELL, MIAMI

MIAMI (Mar. 21, 2025) – Linkvest Capital, through its lending affiliate LV Lending, a private lender specializing in bridge loans for commercial and residential investment properties and developments, has successfully closed a $1.4 million loan to refinance a portfolio of six office spaces totaling 7,059 square feet. Strategically located in Miami’s most dynamic financial, residential, and entertainment district, these offices benefit from their prime position surrounded by more than 100 national and international financial institutions, as well as their proximity to state and federal courthouses. Just steps away from the Metrorail and Metromover stations, the building offers quick and efficient access to the entire city. Additionally, its close proximity to major highways such as I-95 and I-395 ensures seamless connectivity for professionals working in the area. Situated just minutes from Mary Brickell Village and the Brickell Business District, the property provides easy access to a wide array of restaurants, hotels, retail shops, and entertainment options, solidifying its status as a premier corporate destination. Linkvest, through its lending affiliate, has originated more than 650 bridge loans, offering flexible funding solutions to real estate investors and developers across Florida. Recognized as Miami’s financial hub and one of Florida’s most attractive real estate markets, Brickell continues to establish itself as a key center for investment and development. Its strategic location, surrounded by Downtown Miami, Coconut Grove, and Biscayne Bay, provides privileged access to key infrastructure, including the Metrorail, Metromover, and Metrobus, facilitating connectivity to the international airport and other high-demand areas. For more information, please contact Linkvest (LV) Lending at (305) 523-6576, email [email protected], or visit linkvestcapital.com.

LINKVEST CAPITAL FACILITATES $6.6 MILLION LOAN FOR PRE-DEVELOPMENT COSTS OF THREE MULTIFAMILY PROJECTS IN POMPANO BEACH AND FORT MYERS

MIAMI (Mar. 20, 2025) – Linkvest Capital, through its lending affiliate LV Lending, a private lender specializing in bridge loans for commercial and residential investment properties and developments, has announced the closing of a $6.6 million loan to finance the pre-development costs of three multifamily residential projects: Fontana Apartments, Palm Aire Apartments, and an additional 99-unit apartment building. Linkvest, through its lending affiliate, has originated more than 650 bridge loans, providing flexible funding solutions to real estate investors and developers across Florida. The developer, Premium Development, brings over 25 years of experience in real estate development and plans to deliver the following projects: Pompano Beach, part of the Fort Lauderdale metropolitan area, is one of the most dynamic cities in Broward County. With over 110,000 residents, its accessibility to major highways, including I-95 and Florida’s Turnpike, makes it an ideal location for professionals working in the region. Additionally, its proximity to Fort Lauderdale-Hollywood International Airport enhances its appeal for residents and businesses alike. Fort Myers continues to be a high-growth city in the U.S., known for its exceptional quality of life and strong connectivity. The city is near Southwest Florida International Airport, which served over 10 million passengers in 2023, driving economic activity and increasing demand for residential developments. For more information, please contact Linkvest (LV) Lending at (305) 523-6576, email [email protected], or visit linkvestcapital.com.

LINKVEST CAPITAL’S LENDING AFFILIATE, LV LENDING, RECOGNIZED AMONG SOUTH FLORIDA’S TOP COMMERCIAL MORTGAGE LENDERS & BROKERS BY SFBJ

MIAMI (Mar. 14, 2025) – Linkvest Capital is proud to announce that its lending affiliate, LV Lending, has been ranked among South Florida’s top Commercial Mortgage Lenders & Brokers by the South Florida Business Journal (SFBJ). This marks the seventh consecutive year that LV Lending has been included in this prestigious ranking. We extend our gratitude to the Linkvest Network for its continued collaboration in redefining alternative investing through long-term partnerships and a shared commitment to success. At Linkvest Capital, our approach is built on four core pillars: Linkvest Capital has established itself as a leading platform for private bridge loans, offering flexible and creative deal structures tailored to the needs of real estate developers and sponsors. Our ability to think outside the box enables LV Lending to provide timely and strategic capital solutions. Through LV Lending, Linkvest Capital has originated more than 650 bridge loans, delivering customized financing solutions to real estate investors and developers across Florida. For more information, please contact Linkvest (LV) Lending at (305) 523-6576, email [email protected], or visit linkvestcapital.com.

LINKVEST CAPITAL FACILITATES $12.6 MILLION LOAN MODIFICATION FOR PAGANI RESIDENCES REFINANCING AND PRE-DEVELOPMENT

MIAMI (Mar. 14, 2025) – Linkvest Capital, through its lending affiliate LV Lending, a private lender specializing in bridge loans for commercial and residential investment properties and developments, has successfully executed a $12.6 million loan modification to refinance the development site for Pagani Residences and fund the project’s pre-development costs. The development team, Riviera Horizons, is overseeing the development of Pagani Residences, an exclusive luxury residential project that marks the renowned Italian brand Pagani’s debut in the real estate sector. The 27-story boutique building will feature 70 condominiums inspired by the principles of Leonardo da Vinci. The site is located in North Bay Village, in eastern Miami-Dade County, near Bay Harbor Islands and Surfside to the northeast, North Beach and Normandy Isles to the east, and Mid-Beach to the southeast. These areas form part of a network of interconnected barrier islands that separate the city of Miami from the Atlantic Ocean. Market reports indicate that Miami-Dade County has seen significant job growth over the past decade, fueling continued demand for real estate and housing. Additionally, the region benefits from a stable and slightly growing population, along with rising education levels. Linkvest Capital, through LV Lending, has originated more than 650 bridge loans, providing flexible financing solutions to real estate investors and developers across Florida. For more information, please contact Linkvest (LV) Lending at (305) 523-6576, email [email protected], or visit linkvestcapital.com.

LINKVEST CAPITAL AND MMG EQUITY PARTNERS ACQUIRE HOMESTEAD STATION MIXED-USE ENTERTAINMENT CENTER IN DOWNTOWN HOMESTEAD

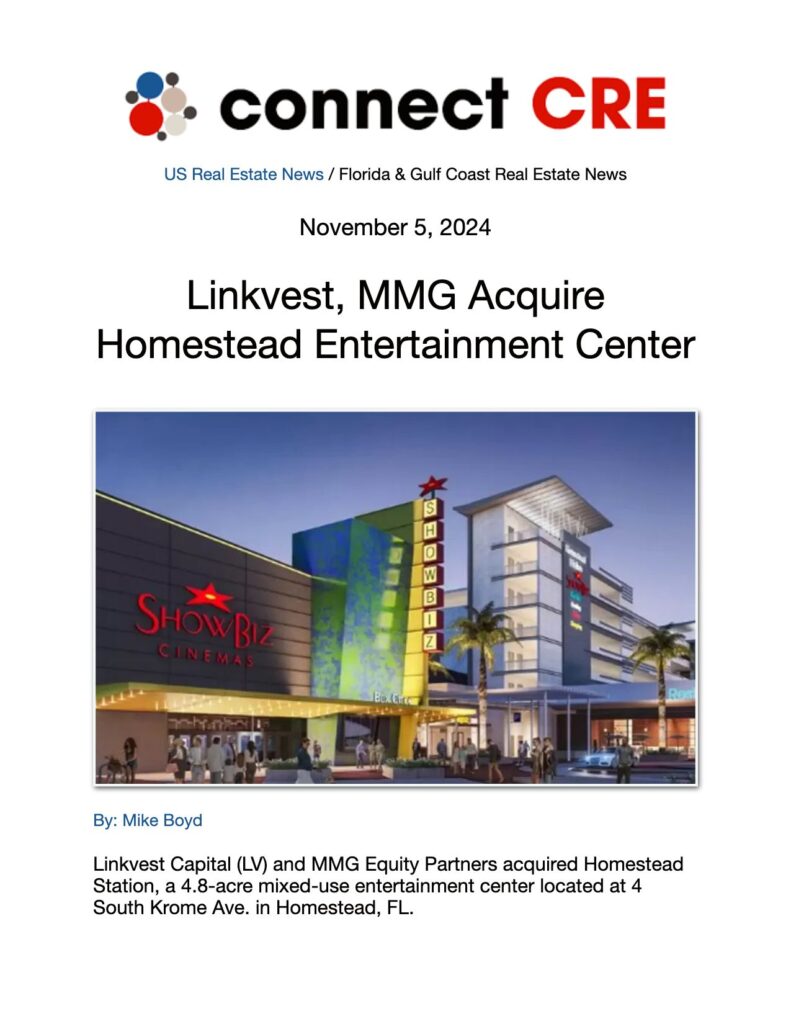

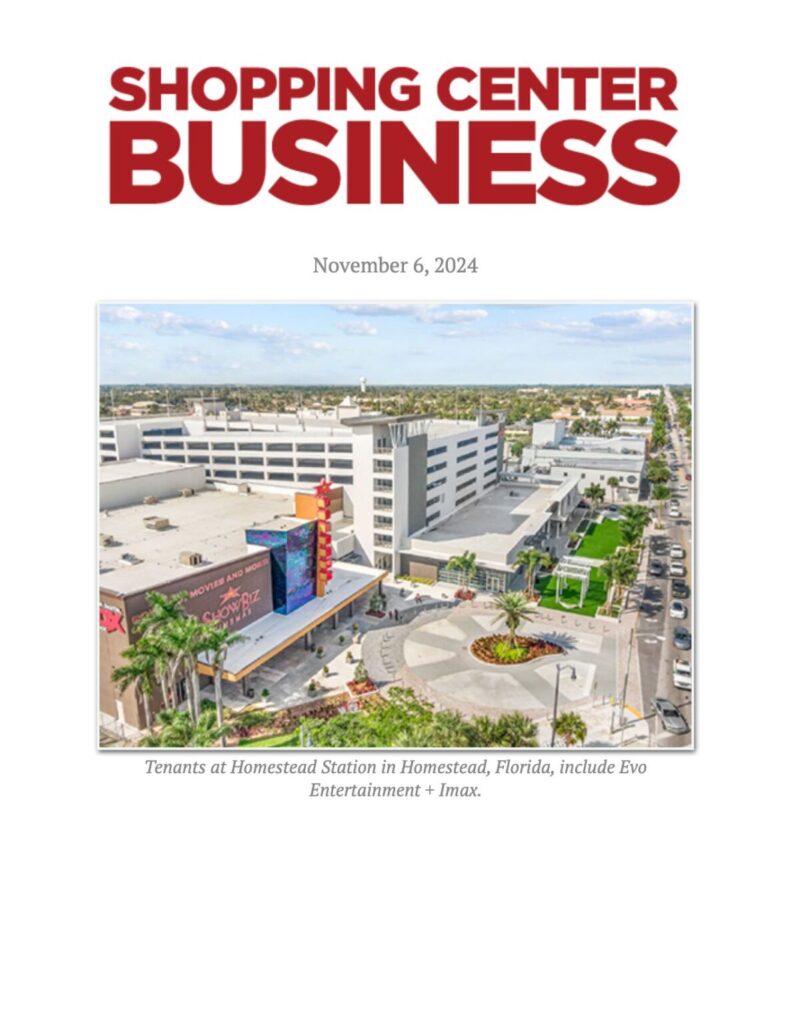

MIAMI (Nov. 4, 2024)–Linkvest Capital and MMG Equity Partners are pleased to announce the acquisition of Homestead Station, a 4.8-acre mixed-use entertainment center located at 4 South Krome Ave. in Homestead, FL. LV Lending previously held a first mortgage on the property, and the acquisition was completed through a deed in lieu of foreclosure. MMG and Linkvest have been working together since 2018 when MMG acquired Tamarack Resort in Idaho (tamarackresort.com) and Linkvest coinvested to successfully redevelop the Resort. “The friendly deed in lieu of foreclosure highlights LV Lending’s commitment to working collaboratively with clients and borrowers,” said Camilo Niño, CEO, Linkvest Capital. “This acquisition, completed amicably, showcases our approach of finding solutions that both protect our investments and respect the needs of our borrowers. We’re excited to build on our partnership with MMG Equity Partners. As a highly respected firm with deep expertise in retail, they bring great value to this venture.” Completed in October 2019, Homestead Station encompasses a variety of amenities, including Evo Entertainment + IMAX featuring cinemas and bowling, and numerous retail and dining establishments. The center also features an 1,100-space parking garage. There is currently 18,000 square feet of vacant space available to lease. “Homestead Station is a cornerstone of the City of Homestead’s downtown revitalization efforts,” added Gabriel Navarro, Principal at MMG Equity Partners. “We look forward to working with the City of Homestead to enhance the offerings and making Homestead Station a premier entertainment, dining, and shopping destination.” Situated in downtown Homestead with convenient access to Florida’s Turnpike, Homestead Station capitalizes on the area’s rapid growth. Homestead Station is adjacent to one of the 14 stations on the South Dade Transit Way, which is scheduled to open in the first half of 2025, providing a convenient transit link for visitors and residents alike. The center is located approximately 26 miles southwest of Miami and 25 miles northwest of Key Largo. For more information and leasing opportunities, please contact Allan Benes, Horizon Properties of Miami, Inc. at [email protected].

Linkvest Capital, MMG Equity Partners Acquire 4.8-Acre Mixed-Use Development in Metro Miami

Miami-Dade entertainment complex trades deed in lieu of foreclosure

Linkvest, MMG Acquire Homestead Entertainment Center