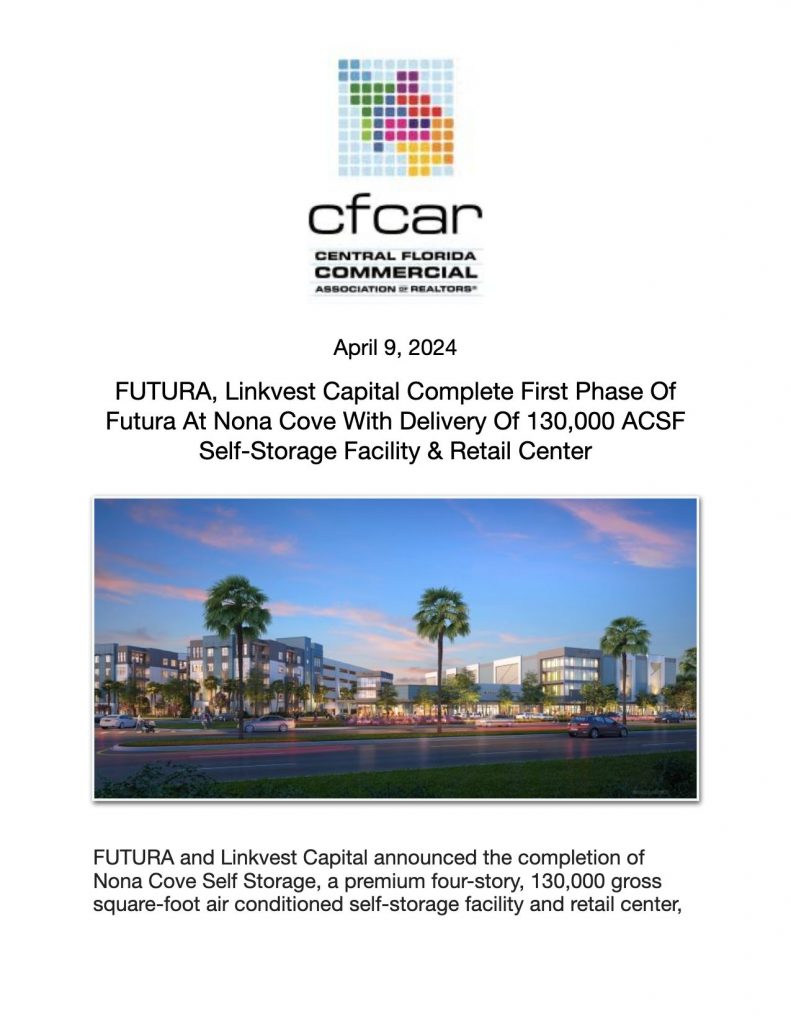

FUTURA, Linkvest Capital Complete First Phase Of Futura At Nona Cove With Delivery Of 130,000 ACSF Self-Storage Facility & Retail Center

Self-Storage Development and Zoning Activity: April 2024

Futura, Linkvest Capital Deliver 130,000 SF Self-Storage, Retail Facility in Orlando

Futura JV Delivers Orlando Self Storage Facility

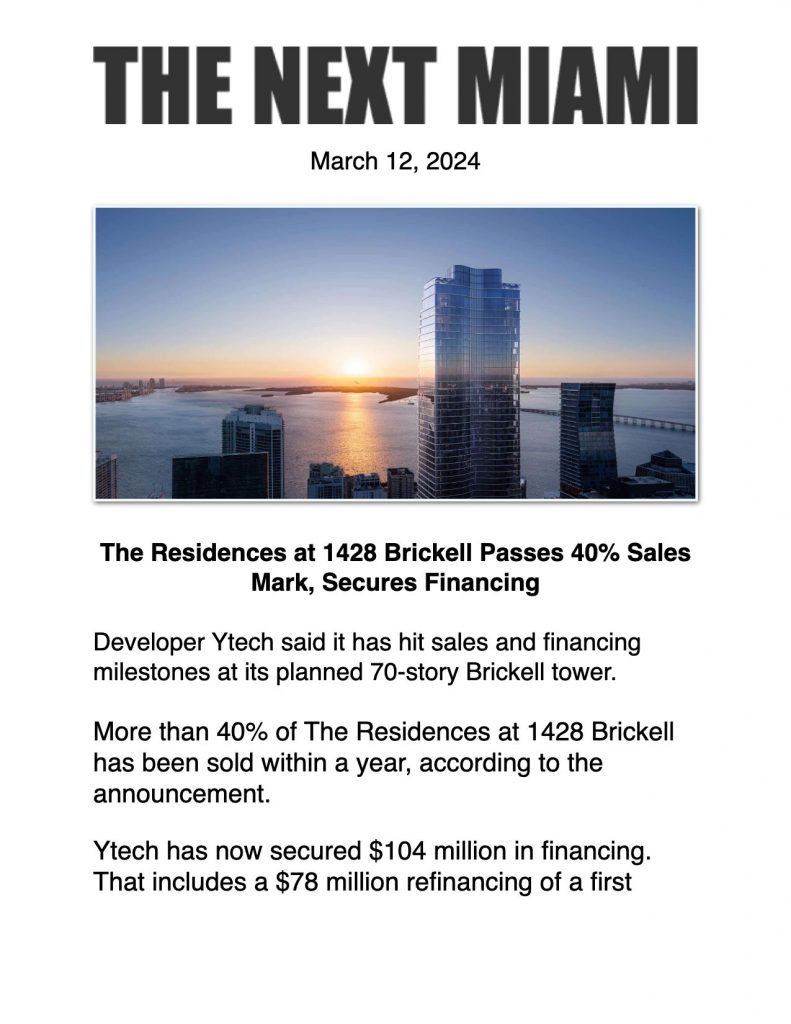

Ytech secures $104 million in construction financing for Brickell condo tower

The Residences at 1428 Brickell Passes 40% Sales Mark, Secures Financing

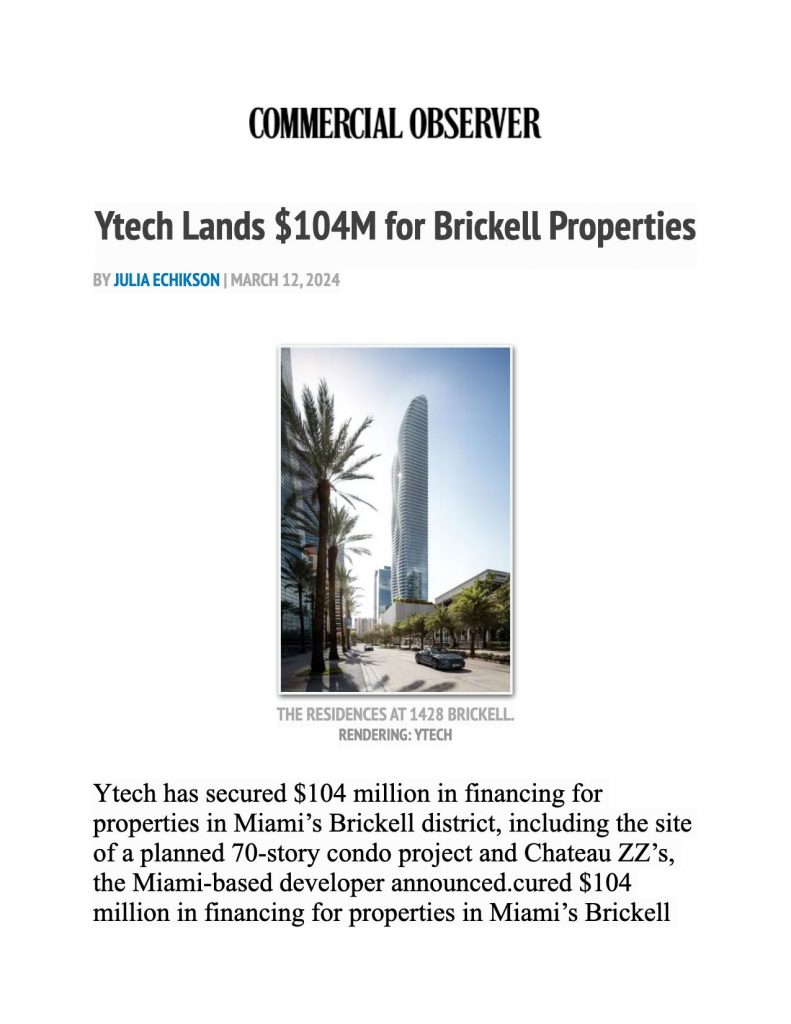

Ytech Lands $104M for Brickell Properties

Ytech scores financing for 1428 Brickell condo tower, historic properties

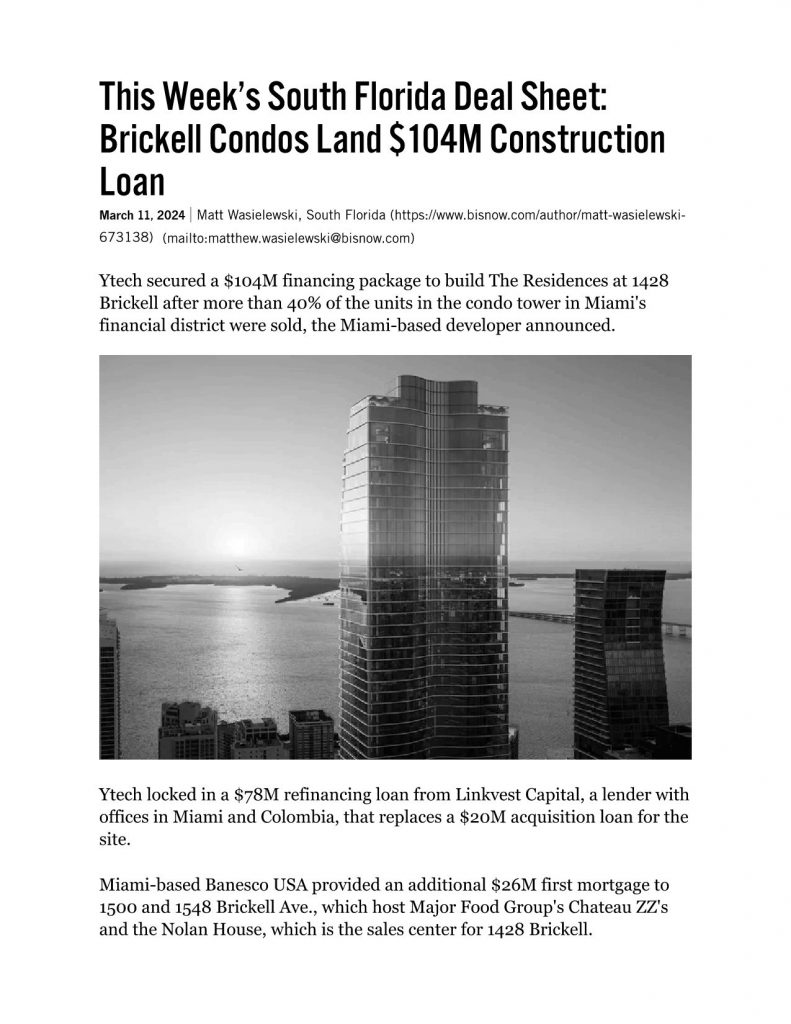

This Week´s South Florida Deal Sheet: Brickell Condos Land $104M Construction Loan

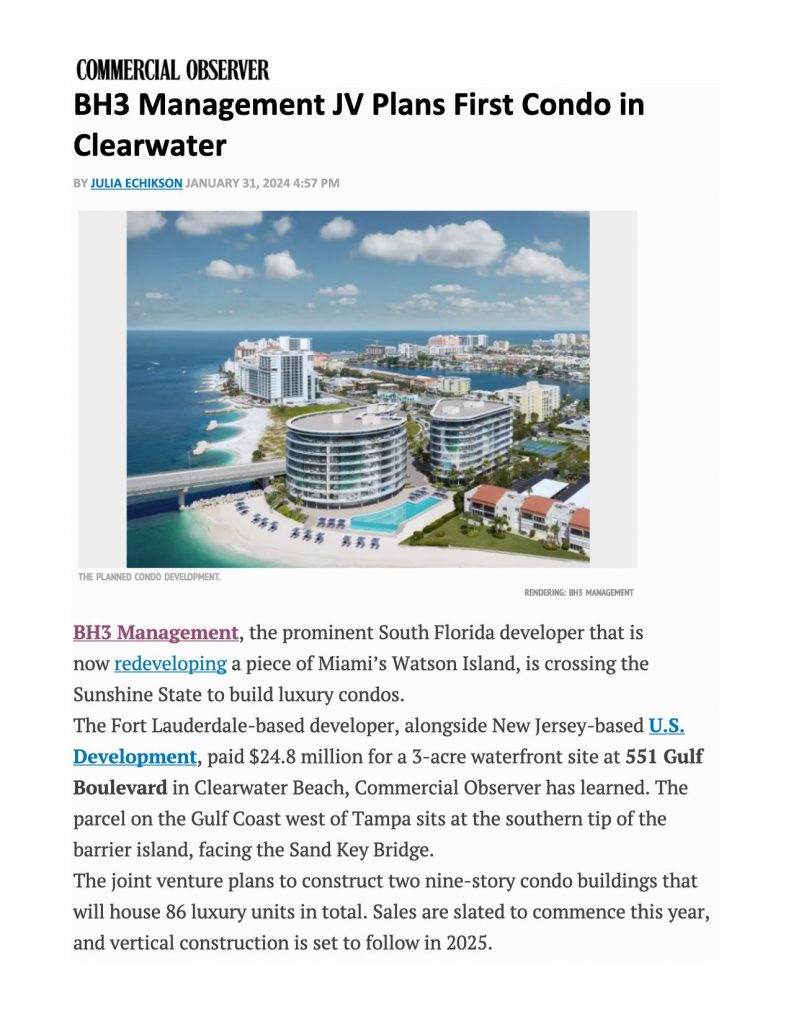

BH3 Management Plans First Condo in Clearwater